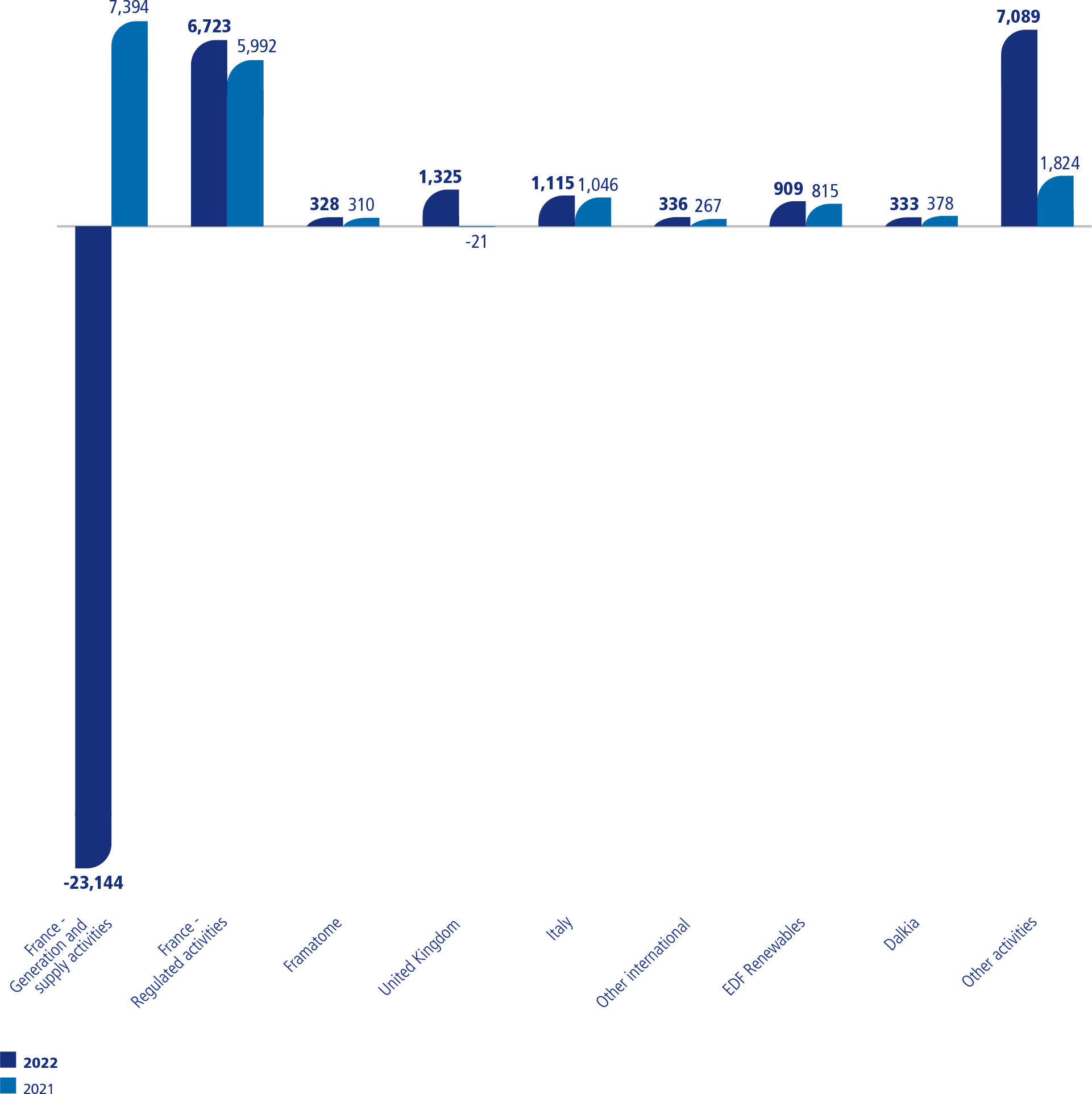

The breakdown of the Group’s Operating profit before depreciation and amortisation by operating segment in 2022 and 2021 is as follows, in millions of euros (see note 4.1):

This graph shows the breakdown of the Group’s Operating profit before depreciation and amortisation by operating segment in 2022 and 2021 is as follows, in millions of euros (see note 4.1).

France - Generation and supply activities

2022 : - 23,144

2021 : 7,394

France - Regulated activities

2022 : 6,723

2021 : 5,992

Framatome

2022 : 328

2021 : 310

United Kingdom

2022 : 1,325

2021 : -21

Italy

2022 : 1,115

2021 : 1,046

Other international

2022 : 336

2021 : 267

EDF Renewables

2022 : 909

2021 : 815

Dalkia

2022 : 333

2021 : 378

Other activities

2022 : 7,089

2021 : 1,824

After elimination of foreign exchange effects and changes in the scope of consolidation, the Group’s operating profit before depreciation and amortisation saw a substantial organic decline of -128% or €(23,082) million. This is principally explained by the contributions of the France – Generation and Supply segment (€(30,534) million), Other activities (+€5,215 million), the United Kingdom (+€1,428 million) and the France – Regulated activities segment (+€731 million).

The negative operating profit before depreciation and amortisation of €(23,144) million for the France – Generation and supply segment (down by €30,534 million) is explained by the electricity purchases at high prices made necessary by the decline in nuclear power output (-81,7TWh), essentially due to the stress corrosion phenomenon, with an estimated impact of €(29) billion. Operating profit before depreciation and amortisation was also affected by the decline in hydropower output of around €(2.5) billion. Finally, only a limited portion of the rise in market prices could be passed on to customers, because of the exceptional measures introduced by the French government to limit the increase in sales prices to customers (the bouclier tarifaire tariff cap and ARENH system adaptations – see note 5.1).

In the Other activities segment, the +€5,215 million increase in operating profit before depreciation and amortisation is mainly explained by the significant rise in this item at EDF Trading, where it was up by €5,168 million, driven by the high business performance in an environment of high volatility across all the commodity markets and different geographical areas.

In the United Kingdom segment, the €1,428 million improvement in operating profit before depreciation and amortisation is principally attributable to the increase in nuclear power output (+5%). The sales and supply activity was negatively affected by price rises being only partly passed on to residential customers, despite significant raises of the tariff cap. Finally, operating expenses were lower, largely as a result of the shutdowns of the Dungeness B, Hinkley Point B and Hunterston B plants.

In the France – Regulated activities segment, the operating profit before depreciation and amortisation was up by €731 million, mainly due to transfers of interconnection income amounting to an estimated €1,723 million from RTE (following the CRE’s decision 2022-296 of 17 November 2022, confirmed by decision 2023-50 of 31 January 2023) and an unfavourable price effect of an estimated €1 billion on purchases to compensate for network losses, reflecting changes in market prices.