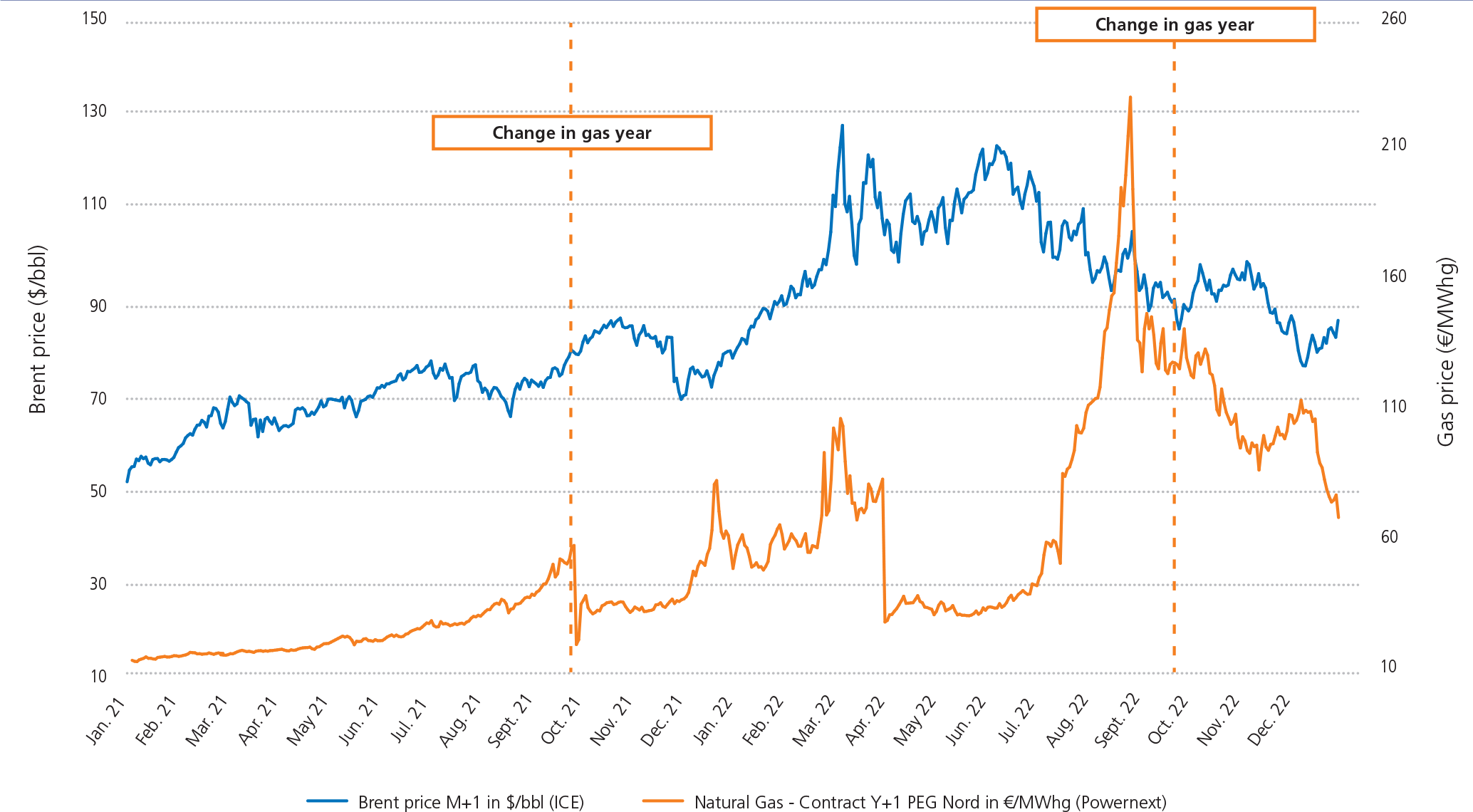

Oil prices stood at an average $99.1/bbl for 2022 (+39.7% or +$28.2/bbl compared to 2021). The market was under strain, and prices were sustained by shrinking supply and geopolitical tensions.

The embargos applied by the European Union, the United Kingdom and the United States because of the war in Ukraine kept prices high. All year long, oil prices fluctuated in response to geopolitical issues caused by the war, but also the risk of a worldwide recession and successive lockdowns in China to cope with the Covid-19 pandemic sweeping the country.

The annual gas contract price for next-year delivery at the French PEG hub reached an average of €82.8/MWh for 2022 (+178.5% or +€53.1/MWh compared to 2021). The energy crisis, already firmly established since October 2021, was accentuated in 2022 by the war in Ukraine. Successive reductions in gas supplies from Russia pushed prices up to record highs, culminating at €231.5/MWhg on 26 August 2022.

However, tensions abated after the European Union’s announcement of coordinated action on the gas and electricity markets in early September. With high European gas stocks over the whole of the final quarter, and a huge influx of LNG supplies to Europe, prices subsequently relaxed.

Natural gas and oil prices

This graph shows the natural gas and oil prices.

Brent price ($/bbl):

2021

January : approximately 56

April : approximately 65

July : approximately 77

October : approximately 79 (Change in gas year)

December : 70

2022

January : approximately 77

April : approximately 99

July : approximately 120

October : approximately 90 (Change in gas year)

December : approximately 88

Gas price (€/MWhg):

2021

January: approximately 12

April : approximately 20

July : approximately 35

October : approximately 55 (Change in gas year)

December : approximately 29

2022

January : approximately 80

April : approximately 65

July : approximately 32

October : approximately 120 (Change in gas year)

December : approximately 99

5.1.2.2 Consumption of electricity and natural gas

5.1.2.2.1 Consumption of electricity and gas in France

Electricity consumption in France was down by 21TWh (-4.5%) from 2021. Milder temperatures during the winter of 2021-2022 resulted in a 8TWh decrease in consumption for heating, but in the summer, high temperatures drove consumption up by more than 3TWh, mainly for air conditioning use. Greater customer awareness of energy sufficiency, and significant price rises, led some businesses to scale back their activity, and this also contributed to the general downturn in consumption. Reductions in consumption hit more than 10% in December.

Gas consumption in 2022 in France was 9.8% lower than in 2021 due to the milder weather and higher prices, which limited demand.

5.1.2.2.2 Consumption of electricity and gas in the United Kingdom

Electricity and gas consumption in the United Kingdom decreased by 6% and 15% respectively compared to 2021, mainly as a result of higher prices and milder weather.

5.1.2.2.3 Consumption of electricity and gas in Italy

Electricity consumption in Italy (1) in 2022 totalled 315.6TWh, a decrease of 0.8% compared to 2021. In the first half of the year, consumption rose due to the post-Covid business recovery and higher temperatures in May and June 2022, which pushed up demand for air conditioning. However, consumption then dropped back slightly in the second half of the year because of milder weather.

Demand for natural gas in Italy totalled 69bcm, down by 9.6% compared to 2021. Industrial consumption fell by 15.0% as a result of substantial price rises for raw materials and commodities, and residential consumption decreased by 11.4% due to milder weather and high prices.

(1) Source of data for Italy: unadjusted data and data provided by Terna, the Italian national grid operator, and adjusted by Edison.