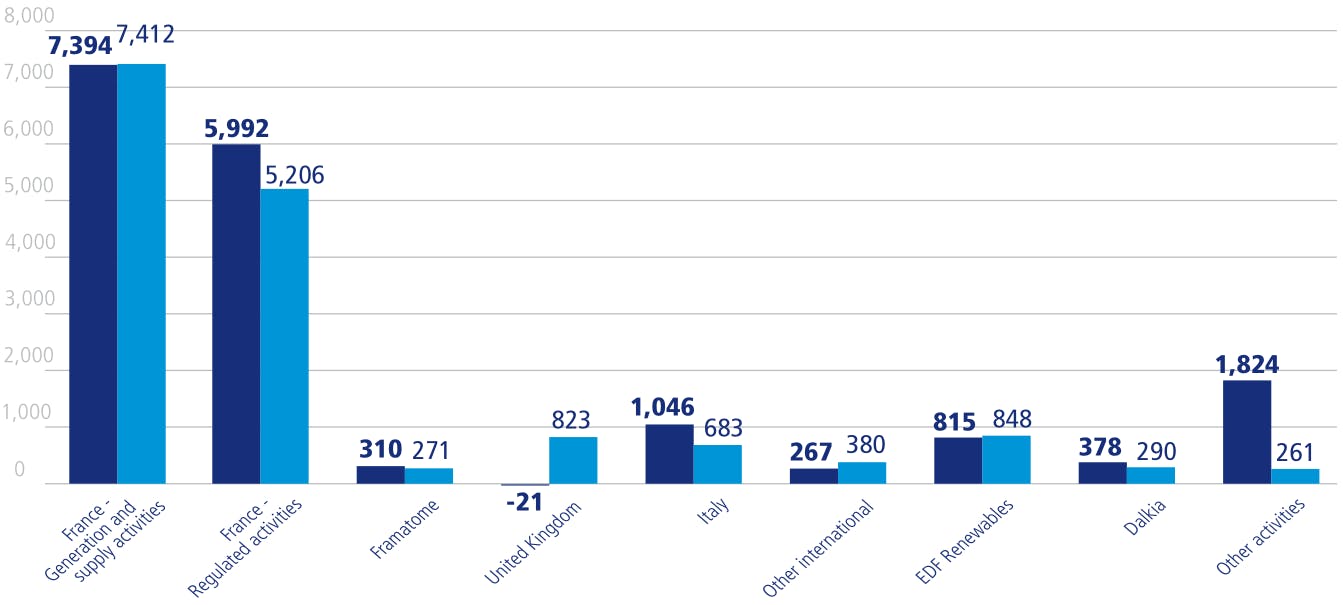

The breakdown of the Group’s Operating profit before depreciation and amortisation by operating segment in 2021 and 2020 is as follows, in millions of euros (see note 4.1):

Operating profit before depreciation and amortisation

in M€

France - Generation and supply activities : 7,394 7,412

France - Regulated activities : 5,992 5,206

Framatome : 310 271

United Kingdom : -21 823

Italy : 1,046 683

Other international : 267 380

EDF Renewables : 815 848

Dalkia : 378 290

Other activities : 1,824 261

After elimination of foreign exchange effects and changes in the scope of consolidation, the Group’s operating profit before depreciation and amortisation registered organic growth of 11.3% or €1,825 million. This increase is principally explained by the contributions of the France – Regulated activities segment (+15.1% or +€786 million), Other activities (+€1,563 million), Italy (+53.0% or +€362 million) and the United Kingdom (-108.0% or €(889) million).

The rise in operating profit before depreciation and amortisation includes €476 million resulting from the lower generation taxes in France under the government measures decided for the national recovery plan, comprising €322 million for the France – Generation and Supply segment and €130 million for the France – Regulated activities segment.

Note that in 2020, operating profit before depreciation and amortisation had been affected by the Covid-19 pandemic which had an estimated impact of €(1,479) million. The principal business segments concerned were France – Generation and Supply (€(872) million), France – Regulated activities (€(237) million) and the United Kingdom (€(182) million).

The stability of the operating profit before depreciation and amortisation in the France – Generation and Supply segment (€(21) million) is explained by several factors, particularly the following two contrasting effects: a 25.3TWh rise in nuclear power output in 2021, whereas generation in 2020 had been greatly affected by the Covid-19 pandemic (estimated impact of 33TWh in 2020 due to modulation and adaptation of the maintenance outage schedule) and a 2.6TWh decrease in hydropower output; and despite the favourable effects of higher generation volumes, very unfavourable energy price effects relating to purchases and sales on the open market as purchases had to be made at very high prices, particularly in the fourth quarter when certain power plants were offline. The operating profit before depreciation and amortisation was also supported by the reduction in generation taxes introduced as part of the French government’s national recovery plan.

Operating profit before depreciation and amortisation for the France – Regulated activities segment registered growth of €786 million, principally reflecting the 15.8TWh increase in volumes delivered due to the favourable climate effect, changes in tariff indexations, and the unfavourable effect of higher energy purchases to compensate for network losses as prices rose substantially at the end of the year. The operating profit before depreciation and amortisation was also sustained by a high number of consumer and producer connections, after 2020 had been affected by Covid-19 measures, and a decrease in generation taxes.

The €(31) million decline in EDF Renewables’ operating profit before depreciation and amortisation was principally due to the negative consequences of the exceptional spell of cold weather in Texas, and conversely, the favourable effect of progress in generation and development and sales of structured assets, mainly in the United States and Portugal.

The Italy segment saw a rise of €362 million in operating profit before depreciation and amortisation, notably reflecting the resumption of business with industrial customers on the gas segment, and residential and business customers on the electricity segment, after the pandemic-affected year 2020. This rise also reflects the colder weather in a context of good performances by fossil-fired and renewable generation, and optimisation activities. The operating profit before depreciation and amortisation was also augmented by the gain on disposal of Infrastrutture Distribuzione Gas (IDG).

In the United Kingdom, the substantial €(889) million decrease in operating profit before depreciation and amortisation is explained by a number of factors: a decline in nuclear power output (-4TWh) and the substantial decline in realised nuclear power prices reflecting purchases made at high prices to serve customers in this context of lower output; a recovery of business with industrial customers, which had been penalised in 2020 by the Covid-19 pandemic; the impossibility in 2021 of passing on energy price rises to customers on the Standard Variable Tariff due to the price cap mechanism, and the takeover of certain suppliers’ customer portfolios in application of the regulator’s supplier of last resort mechanism.

The significant €92 million increase in Dalkia’s operating profit before depreciation and amortisation largely reflects the resumption of services and works after the Covid-19-affected year 2020.

In the Other activities segment, of the €1,563 million improvement in operating profit before depreciation and amortisation, €881 million is attributable to the gas activities, principally reflecting higher gas prices (including the variation in increases/decreases to provisions for onerous contracts between 2020 and 2021), and €567 million is attributable to EDF Trading following the high market volatility observed in Europe and the United States (notably during the spell of extremely cold weather in Texas), and to a lesser degree sales of real estate assets in France.