The Group’s consolidated operating profit before depreciation and amortisation for 2020 amounts to €16,174 million, a decrease of 3.3% from 2019.

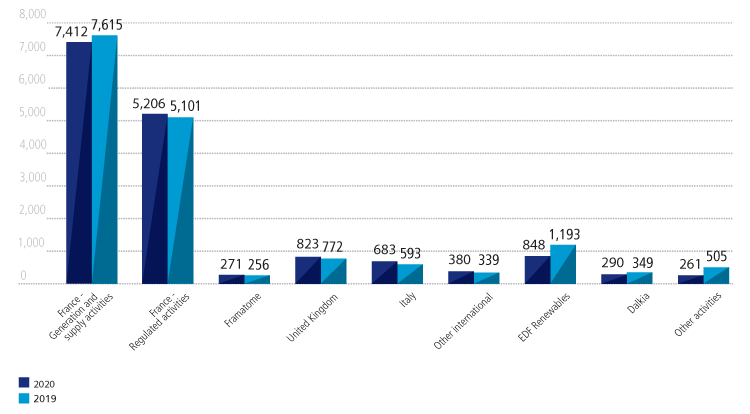

The breakdown of the Group’s Operating profit before depreciation and amortisation by operating segment in 2020 and 2019 is as follows, in millions of euros (see note 4.1):

Operating profit before depreciation and amortisation

In million of euros

France - Generation and supply activities : 2019:7 615, 2020 :7 412.

France - Regulated activities: 2019 : 5 101, 2020 : 5 206.

Framatome : 2019: 256, 2020 : 271.

United Kingdom : 2019 : 772, 2020 : 823.

Italy : 2019 : 593, 2020 : 683.

Other international : 2019 : 339, 2020 : 380.

EDF Renewables : 2019 : 1 193, 2020 : 848.

Dalkia : 2019 : 349, 2020 : 290.

Other activities : 2019 : 505, 2020 :261.

After elimination of foreign exchange effects and changes in the scope of consolidation, the Group’s operating profit before depreciation and amortisation showed an organic decline of -2.7% or €(450) million. This decrease is principally attributable to the France – Generation and Supply segment (-2.7% or€(203) million), EDF Renewables (-23.0% or €(274) million), Other activities (-44.8%or €(226) million) and France – Regulated activities (+2.1% or +€105 million).

The €(450) million decrease in operating profit before depreciation and amortisation in the France – Generation and Supply segment is essentially explained by the effects of the Covid-19 pandemic, estimated at €(0.9) billion, particularly due to lower nuclear power output combined with a decline in consumption. The other effects relating to lower plant availability, including the closure of Fessenheim, were offset by positive energy price effects (including tariff increases – see note 5.1.1) and higher capacity market revenue (see note 5.1).

Operating profit before depreciation and amortisation for the France – Regulated activities segment increased by €105 million despite the €(0.2) billion effects of the Covid-19 pandemic (lower volumes delivered and connection services) and mild weather, supported by changes in the TURPE 5 tariff indexation (see note 5.1.1).

Despite growth in generation activities, EDF Renewables’ operating profit before depreciation and amortisation was down by €(274) million, mainly due to a lower volume of development and sales of structured assets (€(0.3) billion) following the sale of 50% of the offshore wind farm NnG in 2019.

The €76 million increase in operating profit before depreciation and amortisation in the United Kingdom segment is notably attributable to the positive effect of higher nuclear power prices, counterbalanced by the Covid-19 pandemic effects (€(0.2) billion) and lower levels of nuclear generation.

In the Other activities, the €(226) million decline in operating profit before depreciation and amortisation is due to the €(122) million effect in gas activities, principally reflecting an increase in provisions for onerous contracts and a €(82) million downturn at EDF Trading, which achieved a steady performance in 2020after an excellent performance in 2019.