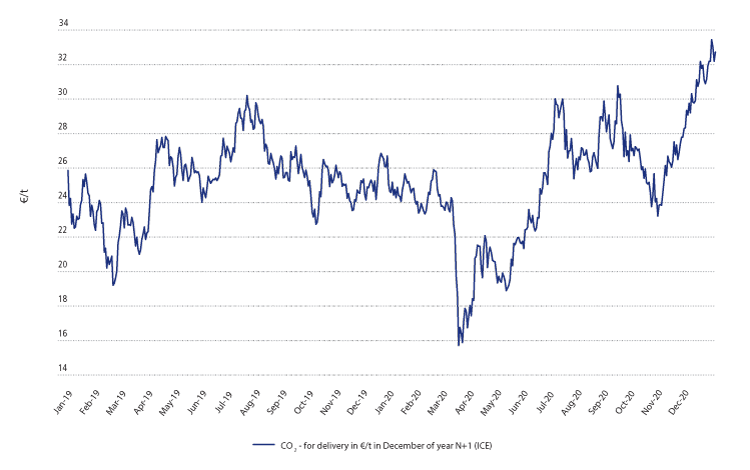

CO2 emission rights prices, in €/t

In January 2019: the price of CO₂ emission rights is approximately 26 €/t

In August 2019: the price of CO₂ emission rights is approximately 30 €/t

In April 2020: the price of CO₂ emission rights is approximately 18 €/t

In July 2020: the price of CO₂ emission rights is approximately 30 €/t

In December 2020: the price of CO₂ emission rights is approximately 34 €/t

5.1.2.1.4 Fossil fuel prices(1)

| Coal (US$/t) | Oil (US$/bbl) | Natural gas (€/MWhg) | |

|---|---|---|---|

| Average price for 2020 | Average price for 2020 Coal (US$/t)58.0 | Average price for 2020 Oil (US$/bbl)43.2 | Average price for 2020 Natural gas (€/MWhg)13.0 |

| Average price variation, 2020/2019 | Average price variation, 2020/2019 Coal (US$/t)- 16.6% | Average price variation, 2020/2019 Oil (US$/bbl)- 32.6% | Average price variation, 2020/2019 Natural gas (€/MWhg)- 29.4% |

| Highest price in 2020 | Highest price in 2020 Coal (US$/t)71.1 | Highest price in 2020 Oil (US$/bbl)68.9 | Highest price in 2020 Natural gas (€/MWhg)16.5 |

| Lowest price in 2020 | Lowest price in 2020 Coal (US$/t)51.8 | Lowest price in 2020 Oil (US$/bbl)19.3 | Lowest price in 2020 Natural gas (€/MWhg)10.7 |

| Price at 31 December 2020 | Price at 31 December 2020 Coal (US$/t)68.9 | Price at 31 December 2020 Oil (US$/bbl)51.8 | Price at 31 December 2020 Natural gas (€/MWhg)16.4 |

| Price at 31 December 2019 | Price at 31 December 2019 Coal (US$/t)56.4 | Price at 31 December 2019 Oil (US$/bbl)66.0 | Price at 31 December 2019 Natural gas (€/MWhg)16.0 |

Coal prices for next-year delivery in Europe stood at an average US$58.0/t in 2020

(-US$ 11.6/t or -16.6% compared to 2019). In the first half of the year, coal prices initially continued the downward trend begun in 2019 due to pessimistic forward demand forecasts all over the world, and the existence of high stocks across Europe. Demand for coal, which was already weakened by competition from gas and the economic slowdown, was hit hard by the lockdown measures and their impacts on economic growth. However, supply was also limited by strikes and economic factors, and this kept coal prices at US$ 55-60/t throughout the third quarter of 2020. In the fourth quarter, the strong recovery by Asian demand, particularly in China for imports from Russia and South Africa, drove a substantial increase in prices.

Oil prices stood at an average US$ 43.2/bbl for 2020 (-US$20.9/t or -32.6% compared to 2019). In the first quarter, the Covid-19 pandemic dramatically reduced demand for oil and set the Brent barrel price on a downward trend for the rest of the year due to its direct impact on mobility (lockdowns, travel restrictions) and its influence on the economy (reduced demand for trade and industrial activity). To support oil prices, OPEC+ took steps to reduce supply in keeping with the disruption to demand, signing an agreement on 12 April to cut production by up to 9.7 million barrels a day. This agreement was negotiated against a background of tensions after a price war between Saudi Arabia and Russia. It was applied throughout the year, with renegotiations in line with hopes of a recovery in demand, and certain adaptations by different stakeholders.

The annual gas contract price for next-year delivery at the French PEG hub was an average € 13.0/MWh in 2020 (-29.4% or -€ 5.4/MWh compared to 2019). During the first half of the year, the impact of the Covid-19 crisis on demand for gas helped to maintain the downward trend begun in 2019. The low demand was combined with mild temperatures, high stocks, and support for non-conventional production in North America. But in June the price slump began to slow down following cancellation of LNG deliveries from the USA and economically-driven closures of certain production sites for non-conventional hydrocarbons. The upward movement continued during the second half of the year, occasionally boosted by unscheduled and scheduled suspension of production in Europe, and more fundamentally the recovery of demand in Asia.

(1) Coal: average ICE prices for delivery in Europe (CIF ARA) for the next calendar year (US$/t);Oil: ICE price for Brent crude oil barrel (front month) (US$/barrel);Natural gas: average ICE OTC prices, for delivery starting from October of the following year in France (PEG) (€/MWhg).